Retail data not all doom gloom according to leading economist

With the cost of living crisis continuing to impact retail trade, latest data suggests consumers are still determined to make “feel good” purchases but are doing so at a much lower price point than previously.

And while the data is grim, at least one leading economist insists it is good news.

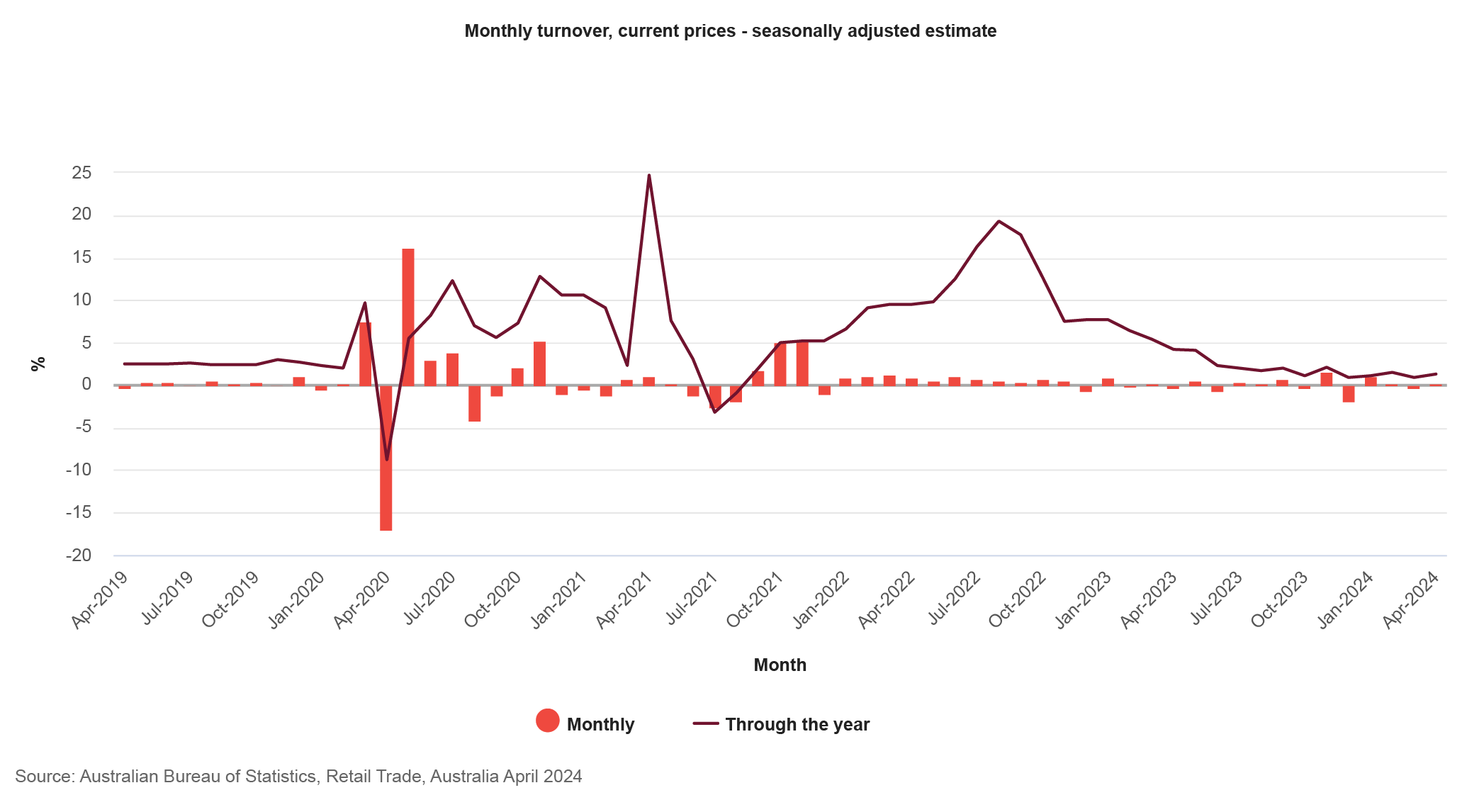

April retail data released by the Australian Bureau of Statistics (ABS), reveals retail trade in Australia in April increased a nominal 0.1% in March and a healthier 1.3% from April 2023, to $35.7 billion.

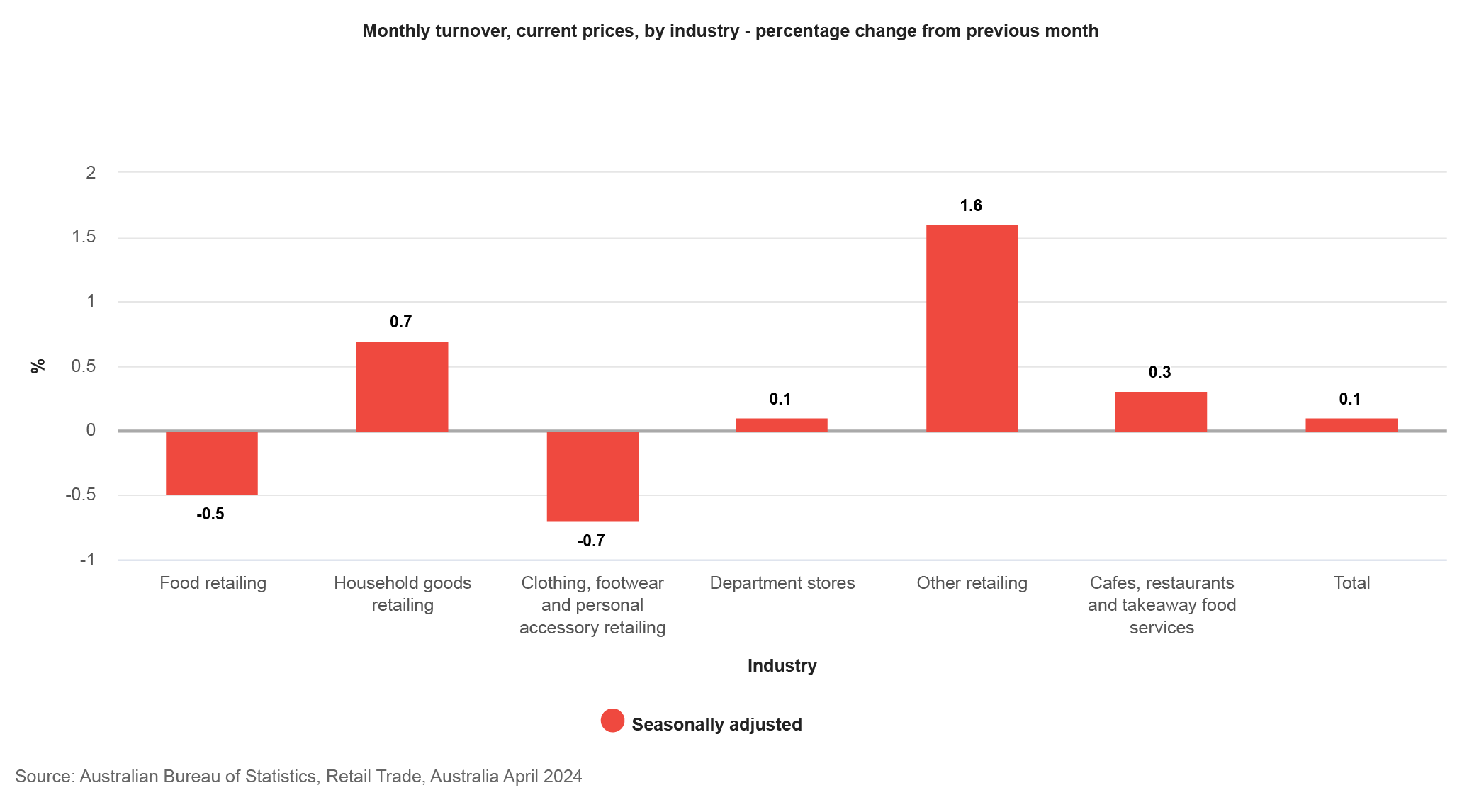

The spending category to record the strongest growth was, curiously, Other

which increased by 1.6% month-on-month (m-o-m) and includes cosmetics, sporting and recreational purchases.

The consistently strong performing Household Goods Retailing increased 0.7% m-o-m and Cafes, Restaurants and Takeaway Food Services rose 0.3% m-o-m.

Food retailing dropped 0.5% m-o-m while the largest drop was in clothing, footwear and personal accessory retailing which decreased 0.7%.

Ben Dorber, ABS head of retail statistics, said the overall increase of 0.1% m-o-m was “not enough to make up for the [4%] fall in March”.

“Since the start of 2024, trend retail turnover has been flat as cautious consumers reduce their discretionary spending,” Dorber continued.

“The relatively earlier Easter and the different timing of school holidays across the country meant we saw some added volatility in turnover in March and April,” Mr Dorber said. “Looking across the past two months, we see weak underlying spending in most parts of the retail industry.”

Paul Zahra, CEO of the Australia Retailers Association (ARA) said an early Easter period created some volatility in the March and April data, there are indications of a “retail recession could be on the horizon”.

“The ongoing cost-of-living pressures, interest rate ramifications and increased cost of doing business make it a very challenging period for those in the discretionary retail sector, particularly for SMBs,” Zahra said.

He explained the Other category recording an increase made it the “only standout performer in April, and that’s typically because beauty products are the last category to be affected by economic downturns”.

In a recent story published by Forbes Advisor, Is The Retail Slump Good News For Australians?, economist and journalist Jason Murphy argues the “terrible” data is actually good news for the Australian economy.

“The atrocious state of Australian retail is a sign that consumer spending is suppressed and the high level of interest rates is doing its job,” Murphy writes.

“Combine that with rising unemployment, and you have a signal that could stop the RBA from considering rate hikes and ensure they deliver, instead, rate relief by the end of the year.

“After months of predicting a rate cut, futures markets recently swung to predicting a hike. But the new data caused a big swing in the chance of a rate hike this year.

“Before the retail figures came out, the futures markets judged a rate hike by September as more likely than not, and if not September then probably November (note: prices for certain futures contracts can be used to judge the chance of an official interest rate hike).

“But now the futures market has cooled its jets. A rate hike this year is now seen as a mere possibility, less than one chance in three, and rate cuts early next year are more likely.”

So there is the good news.

Until rates are cut and the amount of disposable income available to Australian households increases, it may be a tight ride for the retail sector.

But the sector will recover. It always does.